Front:

For many years, some lawmakers and others touted a postcard-size tax return as an indication that tax simplification had been achieved. Professors Hall and Rabushka had one on the cover of their flat tax book released in 1985 (flat tax first proposed in a Wall Street Journal op ed in 1981). Their brief return was truly simple because the flat tax only included a few items in income and only allowed a standard deduction and personal exemption. But you'll see that there was no place to sign. (Also, it's a consumption tax, not an income tax.)

Leading up to the Tax Cuts and Jobs Act (PL 115-97; 12/22/17), a postcard size return was touted by President Trump, Speaker Ryan and others.

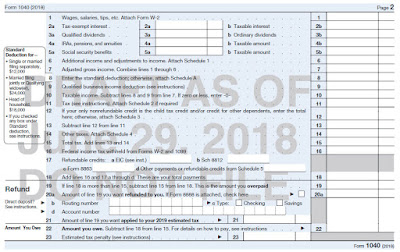

Well, this past week, Treasury and IRS released a draft postcard-size Form 1040:

- IR-2018-146 (6/29/18)

- Treasury

- Draft 1040 - front and back [and there will be no 1040EZ or 1040A!]

- Unlike a postcard, the form will need to be sent in an envelope since it is 2-sided with tax information and there is no room for the sender's address. Also, you'll likely want to include your address and not want the world to see your Social Security Number on the form. There are several schedules that may need to be attached (all postcard size too). But some of the schedules, such as Schedule 1, refer to forms, such as for capital gains/losses, that also need to be attached and won't be postcard size.

- I asked my graduate students how many had ever sent or received a postcard - about 20% had. Mailing postcards are really a thing of the 20th and 19th century. I think Gen Z expect one can file a return with a swipe on an app on their smartphone. Technologically, this is feasible.

- Today, about 90% of individuals e-file (IRS statement in Federal Register seeking comments on the draft forms (FR 34700 (7/20/18)).

- If not e-filed, you may need something larger than a standard letter-size envelope if you don't want to have to fold your "postcard". Query: Will/can Congress change the law to demand postcard postage rate on mailing your 2018 postcard-size return? (35 cents for a postcard versus 50 cents for standard letter or 71 cents for unusual size!) Seems appropriate.

- Most returns are filed via software where it really doesn't matter how many lines are on the return. In fact, software would make it possible to produce a return that only shows the lines you needed. Per the IRS, about 95% of individuals use a paid preparer or software to complete their return (FR 34700 (7/20/18))

- The postcard lists more than five schedules and there might also be one for the Section 199A Qualified Business Income Deduction. The schedules and attachments (with links to the draft if available):

- More than 2 dependents (return doesn't mention a schedule, but the taxpayer will have to state the names and SSN for these people somewhere on the return).

- Schedule 1 – add’l income and adjustments to income

- Schedule A if itemize

- Section 199A deduction – line on page 2; still waiting to learn if there is a form or worksheet for it

- Schedule 2 - Kiddie tax, AMT, payback any Premium Tax Credit, and likely the alternative tax calculation if have net capital gains

- Schedule 3 – Non-refundable credits (not required if only credits are child and dependent credits)

- Schedule 4 – other taxes, such as household taxes, NIIT, individual health insurance mandate (penalty)

- Schedule 5 – other payments or refundable credits

- Schedule 6 - foreign address and designee

- The IRS has also announced that due to these proposed changes to Form 1040, there will no longer be a form 1040EZ or 1040A! Per the IRS: "All filers will use the new Form 1040."

- Treasury expects that 25% of individuals will be able to file just the postcard-size 1040 without the need for any schedules or other attachments. They note that's better than the 16% of filers who used to use Form 1040EZ. (FR 34699 (7/20/18)) That sounds realistic although IRS should be careful should they share this projection with people who don't read the Federal Register because I suspect that many of these people will have worksheets to complete (such as for the EITC or taxable Social Security benefits measure) and many will look at schedules to see if they apply to them (such as Schedule 1 for other income and adjustments). Of course, what really helps is that 95% of filers use a preparer or software.

- Starting for 2019, there must be a Form 1040SR for seniors per legislation enacted in February 2018 (PL 115-123; 2/9/18). As this is required by law, looks like that form will still be needed (but 2019 filings are way off from now!).

- What about the paper waste from people printing the 1040 and new schedules on regular paper when they only take up the top half of the page? Perhaps the makers of tax prep software will include a feature to let you print 2 schedules per page.

What do you think?

1 comment:

Nice article.

Folding table

Post a Comment