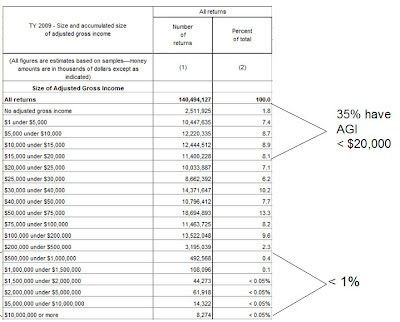

It surprises and shocks me to hear continually that 46% or 47% of individual do not pay any income tax. While there are a few high income individuals in this group who have loss carryovers or a combination of special rules that lower their income out of the paying zone, most of these individuals are low income taxpayers. For 2009, per IRS data, 35% of filers had AGI under $20,000!

How much income tax do we expect these individuals to pay? They are already spending about 9 - 10% of their income on state and local taxes per data from the US Census Bureau. They are also paying federal excise taxes (such as on the purchase of gasoline). Most of these individuals are wage earners paying 15.3% for payroll taxes! (That is a bit more than the 15% rate on capital gains and qualified dividends that are mostly received by high income individuals).

Well, what if the 35% with AGI under $20,000 should have a 1% tax rate? (I do not advocate this, but want to use it as an example). They would pay less than $200 of income tax. Will this make much difference? To the individuals yes, but to the budget no.

The real money is in the special tax rules used by higher income individuals. If someone with income over $200,000 has capital gains of $50,000, their tax savings today with a 15% rate rather than a 20% rate is $2,500. If that person had qualified dividends of $20,000, their tax savings today would be about $4,000. Yes, there are fewer individuals at the high income range than at the low income range, but there is a lot more income at that higher range. And, so far as deductions and exclusions, such as for tax-exempt bond interest, higher income reap a greater benefit from the government (that is, other taxpayers) because their tax savings are greater as they have a higher tax rate.

In the following table, just to give some sense of the aggregate income differences, if you assume that the 8,274 individuals with $10 million or more of income each have only $10 million of AGI (they actually have more), that totals $82.7 billion. If you assume that the 10,447,635 individuals in the chart with $1 to $5,000 of AGI each have $5,000 of income (they actually have less), that totals only $52.2 billion.

The tax savings in the system are going to the higher income individuals. Talk about the 46% who do not pay federal INCOME taxes, is a distractor in the tax reform discussions.

Where is the question about how these individuals live on AGI of $20,000 or less? Of course, many of them likely live with someone else.

I'll have more on this later.

I encourage you to read the Tax Policy Center's recent article, "Five Myths About the 47 Percent." I also encourage you to look at data about our tax system to help understand where its weaknesses truly are and what the extent of our budget problems and needed solutions are. Check here for some helpful links.

Tweet

Search This Blog

Subscribe to:

Post Comments (Atom)

1 comment:

Just wanted to note that there is some interesting discussion on this post at Proformative, which if you haven't seen it, is a great resource for all kinds of business issues and discussion. Here are the comments - http://www.proformative.com/blogs/annette-nellen/2012/09/26/those-who-do-not-pay-income-tax-wrong-focus

Post a Comment